The future of financial management software is here

Understand how today’s technology can benefit your business and drive real growth.

The world of financial management applications has changed: Introducing Microsoft Dynamics 365 Business Central – The next generation financial management software.

But how do you go about realising the potential of your business data?

As it stands, it is not unheard of for businesses to be reliant on highly manual processes, and having to manipulate data between systems and reports via Excel. The simple, traditional financial management software setup is fast proving as outdated a model as paper ledgers once were. Both historically, and a present reality for many businesses, hours of valuable effort have been spent manhandling data into spreadsheets for monthly reporting. Where other systems are required to integrate, this so often means that files are generated from one system or another, and touched up, checked for reconciliation. Microsoft Excel is effectively functioning as duct tape for organisations’ data flows.

Businesses can no longer afford to be tied down by connecting data across their various systems – you don’t have the time to rework the data, let alone tolerate the potential errors and anomalies which can corrupt your data and hinder your decision making. With the future of financial management software you can gain complete connectivity across your systems and achieve “one version of the truth” data.

The future of financial management software and AI – how do these go hand in hand?

One of the most difficult parts for adoption of artificial intelligence into finance platforms has been the understanding of in what cases it is most useful. System bank ledgers can be automatically reconciled with the bank statement, by identifying patterns in the entries and references. Cash flow forecasting and purchase planning can draw upon system data, manual inputs and machine learning to predict what is likely to happen over the coming days and months. Supplier invoices can be read by the system, 3-way matching performed and purchase invoices created and presented for approval, all without a single keystroke.

A modern system should integrate effortlessly with your existing platforms too. With most organisations using Office 365, the proposition of seamless and minimal cost integration should be music to their ears. By unifying these assets you can add real business value and streamline processes: with just a few clicks you can complete all invoicing tasks without even leaving Outlook.

A next generation user needs a next generation system

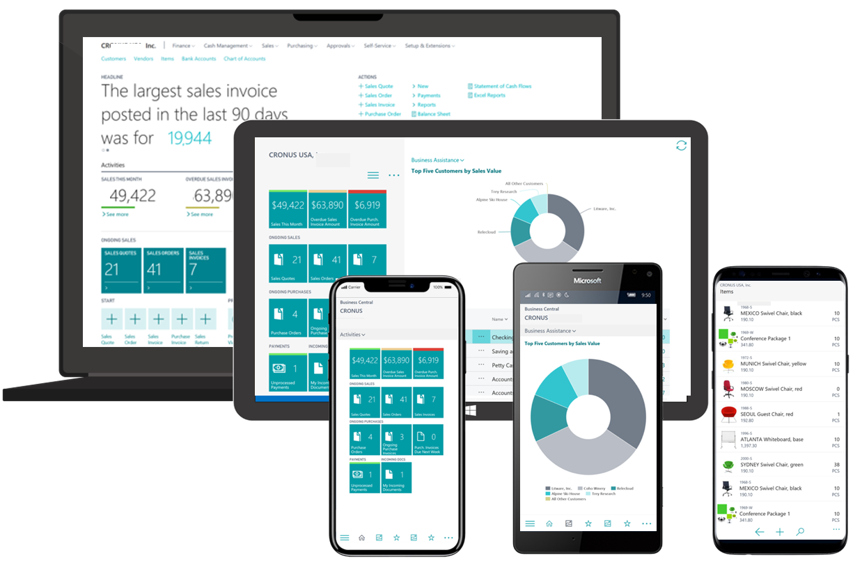

Access, anywhere and at any time delivers clear business benefits. Cloud technology offers the connectivity, security and low maintenance costs that can elevate financial solutions. No upgrade projects are required. No costly scoping exercises. No rework for developments. Just a financial management system that is always on the cutting edge.

Your system needs to be convenient to use, cost friendly and give great peace of mind. The customer is king and the business tools required to service their needs are a contemporary necessity for you to remain responsive. Multi-device access should be the norm, allowing you to increase productivity and facilitate your customer requirements effectively. Actions like sending and amending sales orders on your phone are available and have clear benefits for those working within finance. The future of financial management software can also master compliance for you, easing the concerns of GDPR and Making Tax Digital for businesses.